Georgia Social Security

How does Georgia rank for social security payments?

Georgia ranks 6th out of 50 states for lowest Social Security dollars per capita at $1,867.90. The study is based on a total of 10,201,635 Georgians who received a reported $19,055,604,100 in Social Security Payments in the past year.

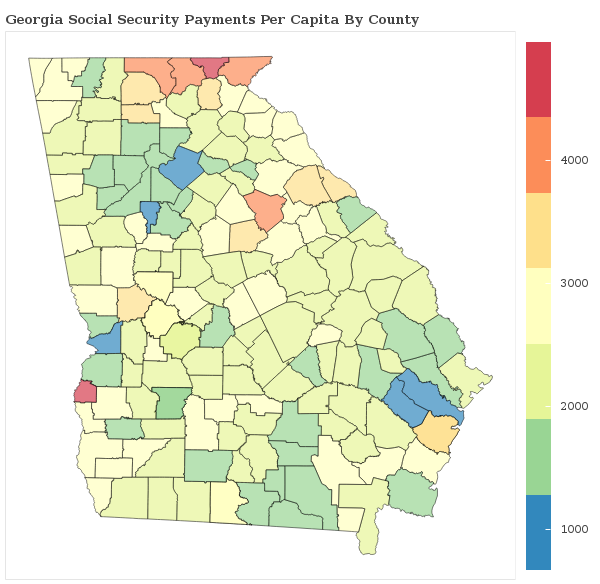

Georgia Social Security Payments By County

Georgia Social Security Received Map

Social Security Received By County

The percentage of households receiving social security in Georgia varies by county.

Applying For Social Security in Georgia

How do I apply for Social Security Benefits in Georgia?

Social Security Benefits are administered by the Federal government, and are available to citizens of all states including Georgia. There are 17 government social security benefits that you may apply for as a resident of Georgia.

Want to explore more government assistance programs? Browse all government benefits available to Georgia residents or all Social Security Benefits

Georgia Social Security Payments by City Statistics

How do the per capita social security payments compare across the largest cities in Georgia?

| City | Payments | Details |

|---|---|---|

Albany |

$1,882.62 |

Albany ranks 180th of 356 among cities in Georgia with the lowest social security payments. Albany residents received $140,993,200 in social security payments in the past year. |

Athens-Clarke County unified government (balance) |

$1,470.91 |

Athens-Clarke County unified government (balance) ranks 93rd of 356 among cities in Georgia with the lowest social security payments. Athens-Clarke County unified government (balance) residents received $179,880,100 in social security payments in the past year. |

Atlanta |

$1,513.27 |

Atlanta ranks 99th of 356 among cities in Georgia with the lowest social security payments. Atlanta residents received $704,018,000 in social security payments in the past year. |

Augusta-Richmond County consolidated government (balance) |

$1,899.28 |

Augusta-Richmond County consolidated government (balance) ranks 184th of 356 among cities in Georgia with the lowest social security payments. Augusta-Richmond County consolidated government (balance) residents received $373,965,600 in social security payments in the past year. |

Columbus |

$1,755.27 |

Columbus ranks 154th of 356 among cities in Georgia with the lowest social security payments. Columbus residents received $348,679,400 in social security payments in the past year. |

Johns Creek |

$1,236.01 |

Johns Creek ranks 52nd of 356 among cities in Georgia with the lowest social security payments. Johns Creek residents received $103,079,300 in social security payments in the past year. |

Roswell |

$1,652.01 |

Roswell ranks 128th of 356 among cities in Georgia with the lowest social security payments. Roswell residents received $155,683,800 in social security payments in the past year. |

Sandy Springs |

$1,660.17 |

Sandy Springs ranks 132nd of 356 among cities in Georgia with the lowest social security payments. Sandy Springs residents received $172,164,500 in social security payments in the past year. |

Savannah |

$1,768.62 |

Savannah ranks 159th of 356 among cities in Georgia with the lowest social security payments. Savannah residents received $256,615,900 in social security payments in the past year. |

Warner Robins |

$1,464.51 |

Warner Robins ranks 92nd of 356 among cities in Georgia with the lowest social security payments. Warner Robins residents received $108,554,000 in social security payments in the past year. |

Research & Reports

Social Security Statistics

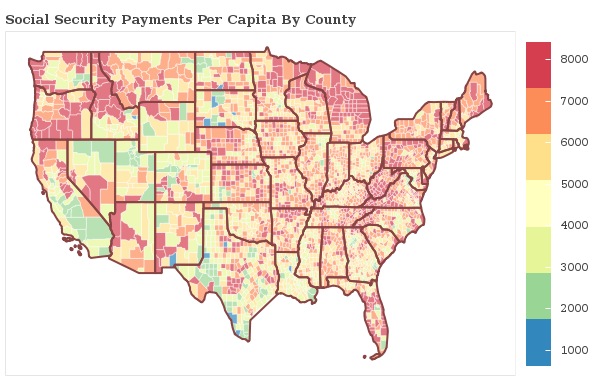

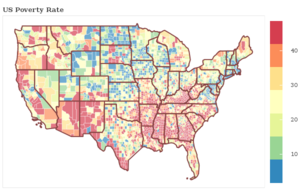

How does Georgia compare nationally? See which states receive the most social security payments.

We breakdown over 3,000 counties nationwide and rank states with the most and least social security payments given to residents.

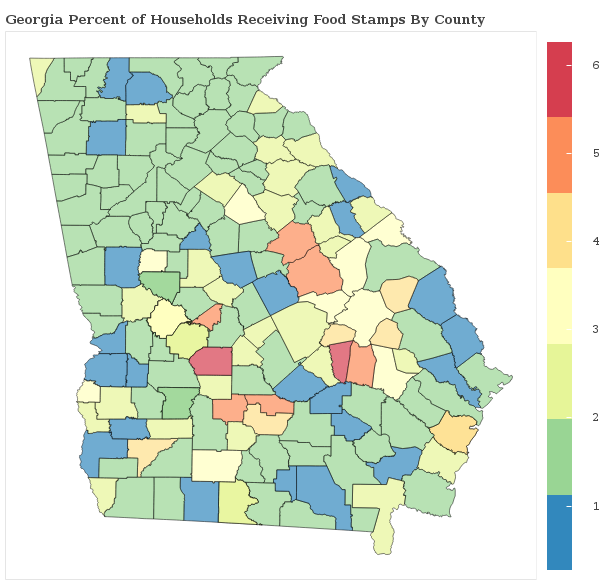

Social Security StatisticsFood Stamp Recipients in Georgia

Which areas receive the most food stamp public assistance in Georgia? We breakdown food stamps by city and county statewide and rank communities with the most and least food and nutrional supplements given to residents.

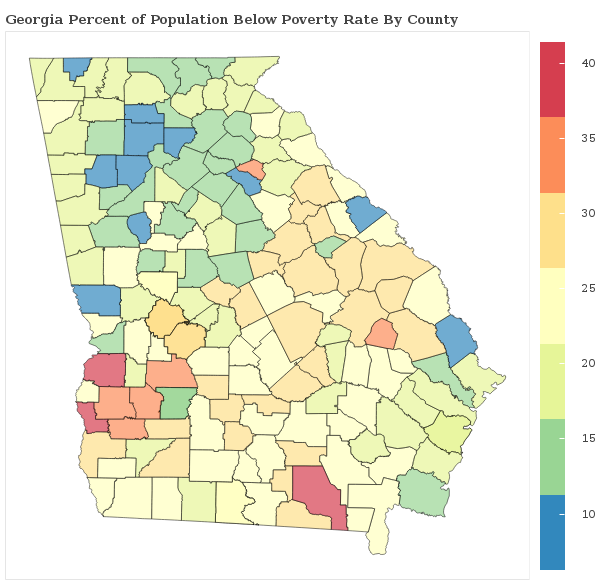

Georgia Food Stamp StatisticsGeorgia Poverty Statistics

Which areas have the highest rate of poverty in Georgia? We breakdown the poverty rate by city and county across Georgia and rank communities with the highest and lowest concentrations of residents living below the poverty line.

Georgia Poverty Statistics2018 Georgia Poverty Line

| Household Size | Poverty Level |

|---|---|

| 1 | $12,140 |

| 2 | $16,460 |

| 3 | $20,780 |

| 4 | $25,100 |

| 5 | $29,420 |

| 6 | $33,740 |

| Per Additional | +$4,320 |

The poverty line for Georgia in 2018 is based on the federal guidelines, which begins at $12,140 for a single person, adding $4,320 for each additional person.